A little “something extra”: when to process an off-cycle payment

There’s a spike in businesses processing off-cycle payroll runs at this time of the year – for plenty of reasons. It could be the discovery of necessary year-to-date (YTD) adjustments through year-end processing tasks (requiring an extra payroll run before the tax year closes); it could be that an organization wants to enter payroll information and submit remittances for manual payments; it could even be to issue a bonus payment to staff (obviously, this one’s everybody’s favourite)!

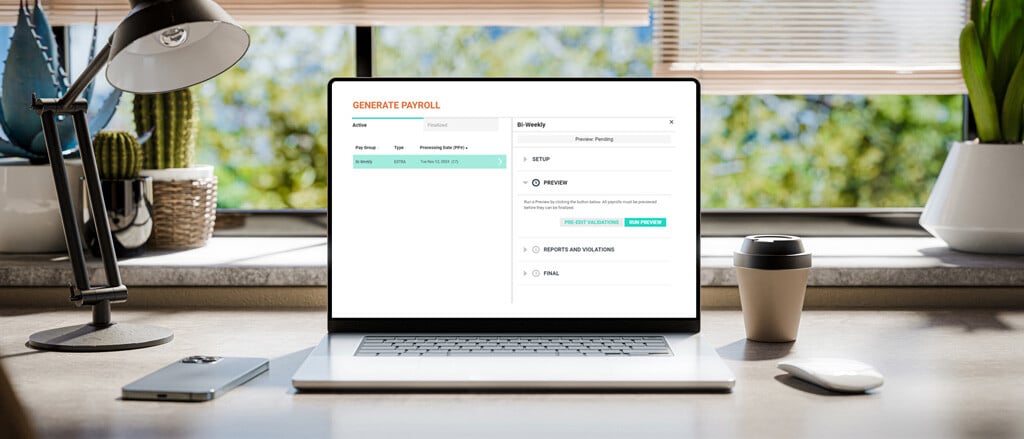

Whatever the reason you might be considering processing an off-cycle payment, let’s get into the fundamentals and how easy it can be when you’re using a payroll solution like Payworks‘.

What’s the difference between an extra run, a bonus run, and an off-cycle run?

In the world of payroll, the terms “extra run”, “bonus run”, and “off-cycle payment” are often used interchangeably (but you can do your future self a favour by delineating between two of them – more on that in the “Payworks pro tip” below). They all refer to the act of processing an additional payroll run that falls outside of an organization’s regular pay schedule. As an example, a business with a semimonthly pay schedule would have 24 pay periods in the year. If there’s a 25th payment, that’s considered an off-cycle payment.

Payworks pro tip: When processing an off-cycle payment in the Payworks system, clients have the option to categorize it as an “extra run” or a “bonus run.” To make reporting easier for yourself down the line, choose “extra run” when processing an off-cycle payment for late hours, pay corrections, retroactive payments, or cash payments, as examples. Choose “bonus run” when issuing a yearly bonus, performance bonus, or a profit-based bonus payment, as examples.

Top tips to determine when to conduct an off-cycle payment

Processing an extra or bonus run is not a part of the regular payroll routine – so how do you know when you should be conducting an off-cycle payment and when you should stay the course and stick to your regular payment schedule? We sat down with our in-house experts to gather a few recommendations on when your organization might want to consider processing an off-cycle payment:

- When you don’t want out-of-the-ordinary payroll information to be grouped with the data from your regular payroll run. This can apply to bonus, cash and retroactive payments, YTD adjustments, and more. This allows for more refined reporting capabilities on your off-cycle payments. By choosing an extra or bonus run, that payroll information will be available separately in your payroll reports.

Payworks pro tip: When you’ve got an extra run to perform, don’t put it off! Ensuring the payment date takes place in the correct tax year means the applicable statutory deductions can be calculated and remitted for compliance and your year-end purposes.

- When you want to make remittances for cash payments. By conducting an extra run, your business will be able to calculate and remit the applicable statutory deductions, which is important for payroll compliance.

Payworks pro tip: Don’t forget that, when you use Payworks’ Payroll solution, we file remittances on your behalf.

- When you want to ensure accuracy (and peace of mind!) for the deductions taking place on staff bonuses. Running these extra payments through a payroll solution like Payworks’ can help simplify complex legislation like “The Bonus Tax Method.”

Curious to learn more? Check out our deep dive into how vacation pay, deductions, benefits and more apply to bonus payments: https://blog.payworks.ca/a-little-something-extra-how-to-process-bonus-payments.

- When you want to save time keying in payroll data. This is particularly relevant to bonus runs, which can result in a lot of additional information to process (and is further amplified if you have a big team!).

Payworks pro tip: It’s possible to manually key the bonus payroll data into the Payworks system; however, this can be time consuming. Instead, easily import the data into our system by simply exporting the payroll grid (creating a workbook in Microsoft Excel), populating the bonus line items, and importing the CSV file back into Payworks. This makes it easy to import bonus payroll data into the system!

How Payworks can help with off-cycle payments

An off-cycle payment can be completed within the Payworks system in eight simple steps – which we get into in detail here: https://blog.payworks.ca/a-little-something-extra-how-to-process-bonus-payments. Navigate to Payroll > Company Setup > Company Info > Run Schedule to get started! Before you process your extra run, ensure you have all of the information required to do so beforehand, including:

- The date on which the extra run needs to be paid out.

- If you want the employee(s) to receive the payment by direct deposit or cheque.

- When you would like the employee(s) to receive the corresponding pay statement.

- The approved value(s) for the payroll grid.

Plus, your dedicated CSR is only a click or call away when you need them. There are also great resources (like “Extra or Bonus Payroll Runs” details) available 24/7 in our client Help Centre.

To learn more about a payroll solution that will meet your needs (and then some), visit: https://www.payworks.ca/landing-pages/product/payroll.

Key topics in this article:

InnovationPayroll ResourcesFinanceBusiness OwnerHR ManagementFranchiseeHospitalityPayroll ManagementThese articles are produced by Payworks as an information service. They are not intended to substitute professional legal, regulatory, tax, or financial advice. Readers must rely on their own advisors, as applicable, for such advice.